Sector Timing with Interest Rates

Revisiting Sector Rotation with Rate Changes

Hi there,

This week, I’m revisiting one of my favorite topics, sector timing. About a year ago, I published “Interest Rates and Sector Rotation”, in which I studied how U.S. sector ETFs respond to shifts in Treasury yields and showed that changes in rates can help predict future sector returns. Back then, I introduced a model-based rotation strategy that ranks sectors by their expected returns from predictive regressions of ETF returns on changes in the 10-year yield. This simple data-driven approach has outperformed traditional 12-month price momentum since 1998.

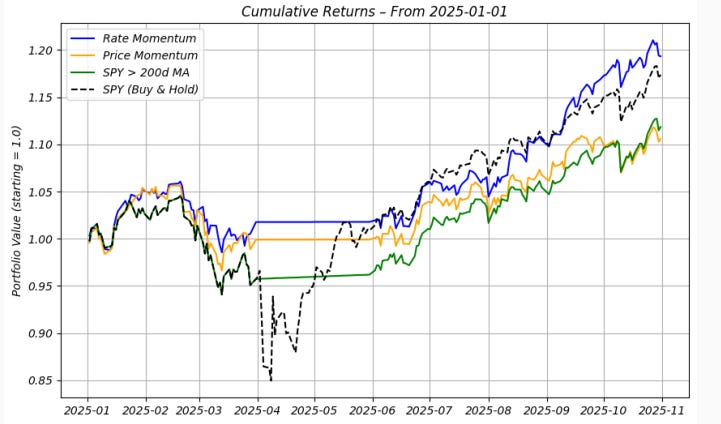

In this update, I revisit that Rate Momentum strategy to see how it has held up since the original post, during 2025, a year that has been anything but quiet for rates. After the sharp declines in yields early in 2025, markets reversed course mid-year amid renewed tariff and inflation concerns, with long-term yields briefly climbing back above 5%. These swings created a challenging environment for traditional momentum and sector-trend models. The goal here is to see whether the Rate Momentum framework could adapt through such macro turbulence and continue to deliver strong performance.

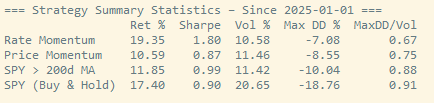

As before, the model ranks sectors by their regression-implied expected returns and moves to cash when SPY trades below its 200-day moving average. The comparison includes standard price momentum (with the same market filter) and SPY buy-and-hold, with performance and exposures updated through October 31, 2025.

So far in 2025, the rate-based model has continued to outperform, returning roughly 19% year-to-date versus 10% for price momentum and 17% for SPY buy-and-hold. While the sample is short, it’s an interesting stress test: The Rate Momentum signal held up during a volatile first half and continued to adapt as yields trended lower later in the year.

Below, I discuss the background and workings of the model and how the sector rankings have evolved over time, and in particular, how the strategy’s exposure has shifted across sectors throughout 2025.