Weekly Research Insights

Economic Uncertainty and Expected Returns | Emerging Market Debt | Predicting Overnight Returns

In this week’s “Research Insights”, I discuss three interesting and recent papers with actionable takeaways and ideas for investors and traders.

Thank you for your continued interest. If you enjoyed the post, consider liking it and subscribing if you haven't already.

In This Post:

Economic Uncertainty and Expected Returns

Emerging Market Debt

Predicting Overnight Returns

Economic Uncertainty and Expected Returns

Economic uncertainty has sharply increased in recent months, both globally and in the U.S. Below, I plot the U.S. Economic Policy Uncertainty (EPU) Index, developed by Baker et al. (2016). This index tracks the frequency of policy-related terms in a broad set of U.S. newspaper articles.

With the exception of the COVID-19 crisis, today’s level of uncertainty ranks among the highest on record. What does this mean for investors and portfolio performance?

A recently published paper by Thorsten Lehnert, “Political Uncertainty-Managed Portfolios”, explores exactly this question. The study investigates whether spikes in policy-related uncertainty can be used to improve portfolio performance. Rather than relying on options-based indicators like the VIX, which have shown mixed predictive power, Lehnert uses the NVIX index introduced by Manela and Moreira (2017). This index is based on front-page articles from the Wall Street Journal, spanning over a century of data. This long-term, news-based measure enables the testing of how stock market returns relate to periods of high political and policy uncertainty.

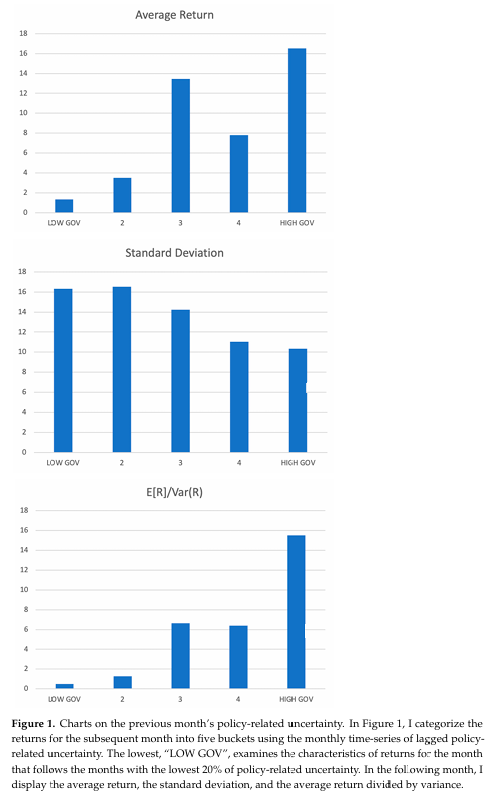

The results are compelling. Lehnert finds that policy-driven uncertainty, particularly news related to government actions and war, is positively associated with future equity market returns. Sorting months into quintiles based on lagged uncertainty, the paper shows that periods of high uncertainty are, on average, followed by significantly higher equity returns compared to periods of low uncertainty.

Source: Figure 1 from Lehnert, T, 2025, Political Uncertainty-Managed Portfolios, Risks 13(3), 55. (Open access: CC-BY 4.0)

Motivated by these patterns, Lehnert proposes a simple strategy: scale up equity exposure during periods of high policy-related uncertainty and scale down during low uncertainty. This “uncertainty-managed” portfolio delivers an annualized alpha of more than 5%, outperforming both passive market and volatility-managed strategies.

While Lehnert’s paper provides time-series evidence showing that equity returns tend to rise following spikes in U.S. policy uncertainty, a recent paper by Gala et al. (2024) shows that political and policy risks are also priced in the cross-section of countries. By sorting countries based on their political and economic policy risks, they find a significant risk premium from investing in high-risk countries over low-risk ones, across multiple asset classes including equities, bonds, and currencies.

Implications for Investors

The evidence strongly suggests that expected returns on equities rise during periods of elevated policy and economic uncertainty. In other words, investors appear to be compensated for taking on such risks, both across time, countries, and assets. This implies that a disciplined increase in equity exposure during uncertain periods could improve long-term risk-adjusted returns.

That said, a word of caution is warranted. When testing or applying strategies based on uncertainty, it’s crucial to use risk measures that are reliable and point-in-time. Some news-based indices may be constructed with hindsight or smoothing, which can introduce look-ahead bias and overstate a strategy’s true performance. Still, the broader message remains: uncertainty doesn’t have to be a liability for investors’ portfolios, it may in fact serve as a valuable signal for long-term investors.

Emerging Market Debt

In a fresh paper by Giesta and Swinkels, “Exploring emerging markets debt: Bond voyage?”, the authors examine the dramatic changes in emerging markets debt over the past two decades. What was once a niche asset class has now grown into a multi-trillion dollar, multi-segment market. The paper provides a comprehensive analysis of four segments of emerging markets debt: local-currency government bonds, hard-currency government bonds, inflation-linked bonds, and corporate bonds, spanning the 2003–2025 period. The authors evaluate these markets in terms of size, composition, risk, and performance.

The paper notes that local-currency bonds have experienced the most growth and offer unique diversification due to their currency exposure, though they are subject to higher volatility. These bonds performed well when emerging market currencies strengthened in the 2000s but struggled during the strong-dollar years after 2013. Hard-currency bonds, while less volatile, behave more like traditional credit assets and offer less diversification. Inflation-linked bonds have delivered strong returns, particularly during inflation spikes, with emerging markets inflation-linked indices often concentrated in countries like Brazil and Mexico. The authors also highlight that current valuations of emerging market currencies are attractive, resembling the conditions of the early 2000s.

Implications for Investors

Emerging market debt now requires a more selective approach due to the variety of segments within the asset class. Local-currency bonds may offer greater return potential in a weakening U.S. dollar environment, while hard-currency debt behaves more like developed market credit and offers limited diversification. Rather than passively allocating across the entire spectrum of emerging markets debt, investors might consider a more tactical approach, identifying which segments align best with prevailing macro trends. That could mean leaning into undervalued currencies, seeking protection through inflation-linked bonds during policy shifts, or focusing on regions with favorable commodity exposure.

Predicting Overnight Returns

It is widely recognized that equity markets exhibit a strong overnight effect, which is observed in both indices and individual stocks. In other words, the majority of the cumulative returns in equity markets tend to occur overnight, when markets are closed, while intraday returns account for only a small portion of total returns.

In a recent paper by Cartea, Cucuringu, Jin, and Wilson titled "Volume Shocks and Overnight Returns," the authors study the relationship between volume shocks (unexpected spikes in trading volume) and stock returns, with a particular focus on the overnight period when markets are closed. While earlier research has connected abnormal volume to returns during the trading day, this study demonstrates that volume shocks are much more predictive of overnight returns than intraday returns. The authors find that stocks with the largest volume shocks tend to show substantially higher returns overnight. Interestingly, this relationship does not hold during the following trading day.

The paper also introduces a theoretical “oracle” strategy, which assumes perfect knowledge of volume shocks, and compares it to more practical, tradable models that use machine learning to predict these shocks before the market closes. Even using basic predictive models, investors can capture up to 90% of the returns of the oracle strategy, with more sophisticated models improving this figure to 97%.

The authors attribute the overnight effect to the slow incorporation of new information, where large intraday volume shocks signal fresh news that takes time to be fully reflected in stock prices. Additionally, they suggest that an overnight risk premium may contribute to this effect, as stock prices adjust during non-trading hours due to factors like lower liquidity and the market’s delayed response to news.

Implications for Investors

For investors, the key takeaway is that trading based on volume shocks, either actual or predicted, at the close of the trading day, holding positions overnight, and selling at the next open can generate significant returns. This strategy can be effective even when using predicted volume shocks, rather than relying on real-time volume data. However, overnight strategies are naturally very sensitive to transaction costs and capacity constraints, while being exposed to overnight gap risk.

The discussion above is based on the following research papers. For full details, please refer to the original sources.

References

Baker, Scott R., Nicholas Bloom, and Steven J. Davis, 2016, Measuring economic policy uncertainty, Quarterly Journal of Economics 131, 1593-1636.

Cartea, Alvaro, Mihai Cucuringu, Qi Jin, and Mungo Ivor Wilson, 2025, Volume shocks and overnight returns, SSRN Working Paper 5156605.

Gala, Vito D., Giovanni Pagliardi, Ivan Shaliastovich, and Stavros A. Zenios, 2024, Political risk everywhere, SSRN Working Paper 4674860.

Giesta, Joao, and Laurens Swinkels, 2025, Exploring emerging markets debt: Bond voyage?, SSRN Working Paper 5188171.

Lehnert, Thorsten, 2025, Political uncertainty-managed portfolios, Risks 13(3), 55.

Manela, Asaf, and Alan Moreira, 2017, News implied volatility and disaster concerns, Journal of Financial Economics 123, 137-162. (SSRN Working Paper 2382197)

Disclaimer: This newsletter is for informational and educational purposes only and should not be construed as investment advice. The author does not endorse or recommend any specific securities or investments. While information is gathered from sources believed to be reliable, there is no guarantee of its accuracy, completeness, or correctness.

This content does not constitute personalized financial, legal, or investment advice and may not be suitable for your individual circumstances. Investing carries risks, and past performance does not guarantee future results. The author and affiliates may hold positions in securities discussed, and these holdings may change at any time without prior notification.

The author is not affiliated with, sponsored by, or endorsed by any of the companies, organizations, or entities mentioned in this newsletter. Any references to specific companies or entities are for informational purposes only.

The brief summaries and descriptions of research papers and articles provided in this newsletter should not be considered definitive or comprehensive representations of the original works. Readers are encouraged to refer to the original sources for complete and authoritative information.

This newsletter may contain links to external websites and resources. The inclusion of these links does not imply endorsement of the content, products, services, or views expressed on these third-party sites. The author is not responsible for the accuracy, legality, or content of external sites or for that of any subsequent links. Users access these links at their own risk.

The author assumes no liability for losses or damages arising from the use of this content. By accessing, reading, or using this newsletter, you acknowledge and agree to the terms outlined in this disclaimer.