Which Sectors Move the Market on Fed Days?

Insights on Sector Behavior Ahead of Next Week’s Fed Meeting

With another FOMC meeting coming up next Wednesday, it’s worth asking the question: Which sectors actually move the market on Fed days? In a previous post, we documented the pre-FOMC drift, the tendency for stocks to rise into scheduled Fed meetings. That pattern has persisted for decades and becomes even stronger during periods of elevated uncertainty and high VIX. We also showed how a simple strategy built around this effect has delivered a 5–9% CAGR despite trading only about 5% of all days.

Naturally, this raises a bigger question:

If the FOMC drift exists at the index level, which sectors are actually driving it? And do all sectors react the same way on Fed days?

In today’s post, we quantify how major U.S. sectors behave on scheduled FOMC announcement days versus all other days. Scheduled meetings are key; they’re the ones investors can position for ahead of time, and they form the foundation for the sector-rotation strategy later in the post.

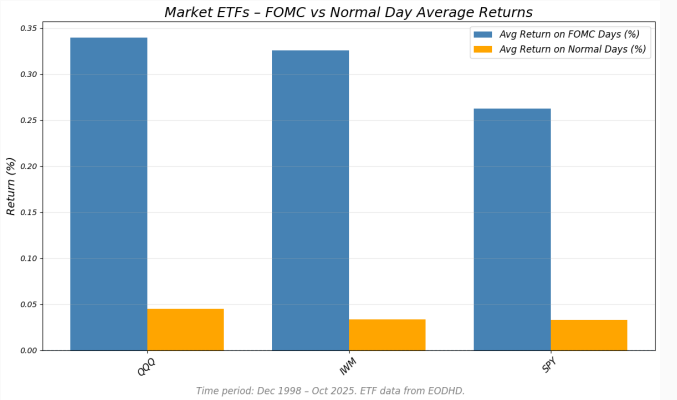

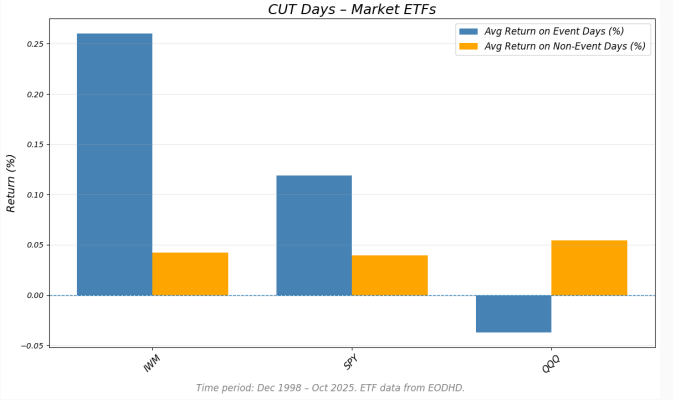

Market ETFs: FOMC Days Deliver Roughly 7× Higher Daily Returns

Let’s start with the big picture. Across SPY, QQQ, and IWM, we see a consistent pattern: Equities show a strong drift on scheduled FOMC days. Equities have delivered roughly 30 basis points on announcement days, on average, versus roughly 4 basis points on all other days.

Stocks simply drift higher leading up to the Federal Reserve’s policy rate decision.

This lines up perfectly with our earlier research on the pre-FOMC drift: Equity markets tend to strengthen both before a meeting and on the announcement day itself.

The leading explanation is the resolution-of-uncertainty hypothesis. As we approach the meeting and the outcome becomes clearer, uncertainty is priced out and risky assets grind higher. Supporting this interpretation, the effect is strongest during high-volatility periods.

But here’s where things get interesting:

Sector behavior on FOMC days is anything but uniform. Some industries surge, others barely move, and one important sector consistently lags.

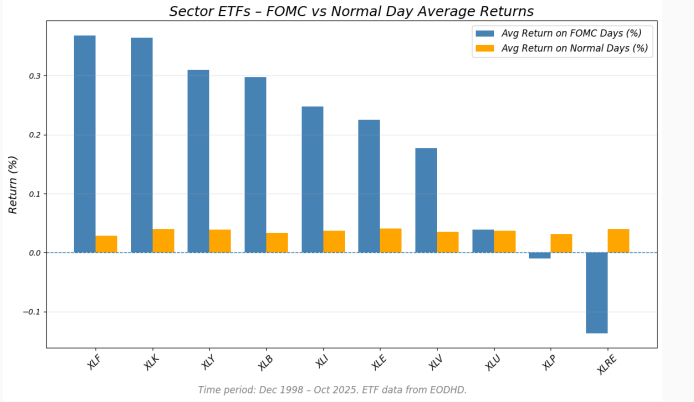

Sector ETFs: Strong Winners, Weak Responders, and One Sector That Consistently Lags

Just like the broad indices, many sectors show elevated returns on FOMC days, but the differences across industries are substantial:

Financials (XLF) show the strongest performance

Technology (XLK) and Consumer Discretionary (XLY) jump as well

Industrials (XLI) and Materials (XLB) show steady positive drift

Utilities (XLU) barely move

Real Estate (XLRE) actually underperforms

Financials (XLF): The biggest winner

Banks, insurers, and lenders are highly sensitive to changes in interest-rate expectations. When uncertainty around future funding costs disappears, the sector reprices sharply and immediately.

Technology (XLK) & Consumer Discretionary (XLY): Long-duration sectors pop

These sectors tend to rely on long-dated cash flows; anything that reduces uncertainty around discount rates tends to lift valuations. When the Fed removes ambiguity, these growth-tilted areas usually rally.

Industrials (XLI) & Materials (XLB): Classic macro-beta sectors

These cyclical industries respond to greater clarity about the economic outlook and interest-rate path. Their FOMC drift is positive but less explosive.

Utilities (XLU) and Consumer Staples (XLP): Defensives barely react

Defensive sectors react less to changes in day-to-day uncertainty, and their reaction on FOMC days is muted.

Real Estate (XLRE): The biggest surprise, and it underperforms

Despite being highly sensitive to interest rates, REITs don’t show a relief rally on FOMC days. Instead, XLRE often reprices slightly lower once the uncertainty clears. A small caveat: XLRE data begins only in 2015, so the sample is shorter and the estimation uncertainty is larger.

Taken together, these results tell us that the FOMC drift isn’t just a broad-market phenomenon. It’s deeply sector-specific, with clear winners and consistent laggards.

Do Sectors React Differently on Hike vs Cut Days?

So far, we’ve looked at how equities behave on all scheduled FOMC announcement days. But the Fed doesn’t always deliver the same type of policy shock. Some meetings end with a rate hike, others with a cut, and many with an unchanged outcome.

It turns out the type of decision matters a lot.

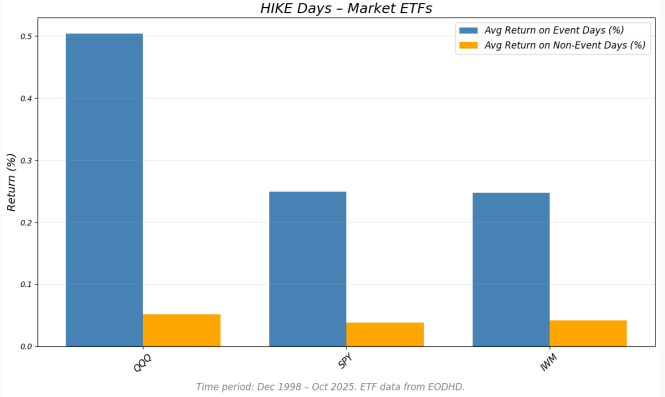

Market ETFs: Hikes Boost Tech, Cuts Boost Cyclicals

Hike days: Surprisingly strong across the board

QQQ is the standout, returning over 0.5% on average.

SPY and IWM also deliver strong gains, around 0.25%.

This may look counterintuitive. Why do stocks rally when borrowing costs rise?

Probably because hikes that happen were already priced in. When the Fed hikes exactly as expected, it removes downside risk. Markets interpret this as clarity rather than a tightening shock. This is a form of uncertainty resolution.

There’s also a cyclical component. Rate hikes often occur in periods of strong economic momentum, when growth, employment, and corporate earnings are improving. In those environments, equities can rally even as policy tightens because improved cash flows and lower risk premia more than offset the drag from higher borrowing costs.

The key exception is a stagflationary backdrop, such as in 2022, when the Fed is forced to raise rates into a weakening economy. In those cases, hikes are genuinely contractionary, and stocks typically don’t respond with the same resilience.

Cut days: Mixed reactions

IWM jumps strongly, suggesting that small caps benefit most from easing

SPY rises modestly

QQQ actually dips slightly

Cuts typically happen during periods of stress or weakening macro conditions. So a rate cut is not automatically “good news”; it often reflects the reasons the Fed was forced to cut in the first place.

Caveat: There are far fewer hike and cut observations than unchanged meetings, so these averages carry wider standard-error bands and should be interpreted with more caution.

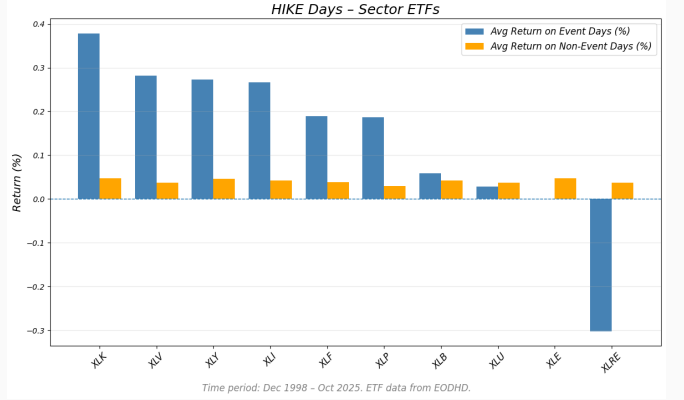

Sector ETFs: Completely Different Leadership Depending on the FED Decision

Hike days: Tech leads, real estate lags

Technology (XLK) is the clear winner, rising nearly 0.4% on average.

Healthcare (XLV) and Consumer Discretionary (XLY) follow closely.

Cyclicals like Industrials (XLI) and Financials (XLF) also post consistent gains.

Energy (XLE) lags, and Real Estate (XLRE) sharply underperforms.

This pattern aligns perfectly with the idea that expected hikes lower uncertainty rather than tighten financial conditions. Long-duration and growth-linked sectors pop on the regained clarity.

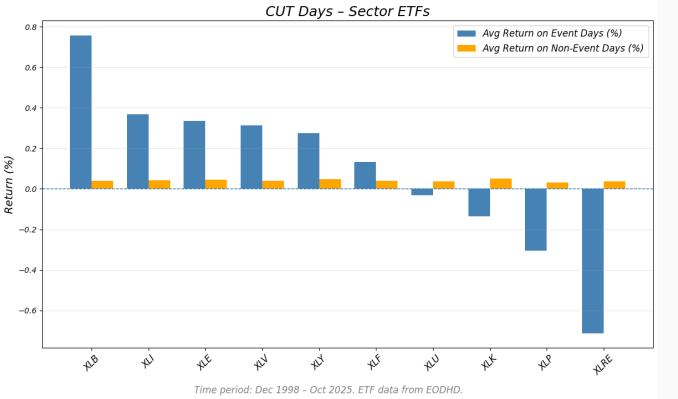

Cut days: Cyclicals rip higher, defensives lag

Materials (XLB) show by far the strongest performance, a huge 0.7–0.8% jump.

Industrials (XLI) and Energy (XLE) also rise strongly.

Healthcare (XLV) and Consumer Discretionary (XLY) do well but more modestly.

Tech (XLK) barely moves.

Real Estate (XLRE) again posts large negative returns.

Cuts are typically a response to weakening economic conditions. In that environment:

Cyclicals bounce sharply (Materials, Industrials, Energy).

Defensives and real-estate lag (XLU, XLP, XLRE).

Growth/Tech shows muted reaction, falling rates help valuations, but recession risk and risk premia offset it.

A caveat: XLRE has relatively few hike and cut observations, so its results should be interpreted with caution.

What This Means for Investors

These results clearly show that FOMC reactions are not uniform across sectors. The broad FOMC drift (stocks going up on Fed days) is real, but how that drift shows up depends heavily on the type of policy move:

Hikes → relief rally, growth, and tech lead

Cuts → cyclicals rally but real estate and defensives lag

Unchanged → returns look similar to the overall FOMC drift

Summing up the evidence so far:

Hikes

Sector Leaders: XLK, XLY, XLV

Sector Laggards: XLE, XLRE

Cuts

Sector Leaders: XLB, XLI, XLE

Sector Laggards: XLP, XLRE

This naturally leads to the big question:

If certain sectors reliably outperform around FOMC announcements, can we build a simple, tradable strategy that exploits this pattern?

That’s exactly what we’ll test next.