Tactical Allocation and Market Regimes

Balancing Growth and Defense in Shifting Market Environments

Markets don’t behave the same in every environment. Some strategies thrive in calm, trending markets, while others do better during volatile, mean-reverting conditions. Rarely does a single strategy deliver across all regimes. That’s why it’s just as important to understand when your strategy works, and when it doesn’t, as it is to look at headline performance statistics.

The ideal goal of a tactical asset allocation (TAA) model is to generate returns across all regimes, regardless of whether volatility is low or high, whether fear is rising or falling. In reality, no strategy outperforms everywhere. The real test is whether it can limit drawdowns in hostile environments while still outperforming in favorable ones. Striking that balance is what enables steady compounding over time.

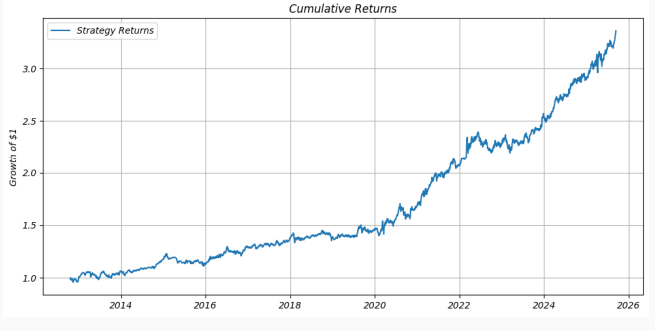

The TAA model discussed earlier is designed to rotate between equities and a basket of defensive assets using a momentum-based allocation framework. Over the full sample, it has delivered equity-like returns with significantly lower drawdowns and a higher Sharpe ratio than that of the S&P 500.

This makes it a strong candidate for capital preservation and growth, but an interesting question is: How robust is that performance across different market regimes?

In this week’s post, I revisit the TAA model, review its latest allocations, and break down how it performs across distinct market regimes. The results highlight when the model’s defensive sleeve provides protection, and when equities drive returns.

More details below.