The FOMC Day Puzzle: Why Every G10 Currency Rallies Against the Dollar

Announcement-day premia, risk-on dynamics, and a simple low-frequency macro overlay

Yesterday’s FOMC meeting delivered a third straight 25-bp rate cut, lowering the funds rate to 3.50%–3.75% amid signs of slowing growth and a cooling labor market. The move was widely expected, but divisions within the committee and lingering inflation concerns underscored a still data-dependent path ahead. The Fed also announced it will begin purchasing short-dated Treasury bills to keep reserves ample, a modestly dovish shift.

Despite overnight selling pressure, the market reaction during yesterday’s session followed the familiar FOMC pattern we’ve discussed in earlier posts: Equities pushed higher while volatility fell. Cyclical sectors such as Materials (XLB) and Industrials (XLI) outperformed defensives like Utilities (XLU) and Consumer Staples (XLP), mirroring the results I highlighted last week regarding FOMC cutting days. Taken together, the evidence continues to show that FOMC days often carry a clear risk-on pattern.

Source: Screenshots from Tradingview

This week, I take a look at currencies. Given how reliably risk assets react to FOMC days, an important question is whether similar dynamics spill over into FX markets. The initial reaction yesterday suggests they do: The U.S. dollar weakened, with UUP down roughly half a percent. That raised a natural question for today’s post:

Does the USD systematically depreciate on FOMC days?

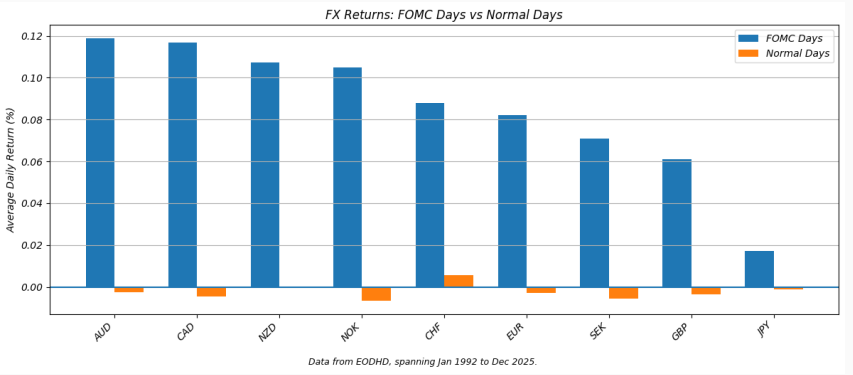

To study this, I look at daily FX spot returns for the so-called G10 currencies: AUD, CAD, CHF, EUR, GBP, JPY, NOK, NZD, and SEK, all versus the USD. As in my previous posts, I focus on scheduled FOMC announcements since these are the events investors can anticipate and position around.

Using daily spot data from EODHD, I analyze the period Jan 1992 to Dec 2025. The figure below compares the average currency return on FOMC announcement days with all other trading days. All returns are spot returns.

The pattern is remarkably consistent. Spot returns on FOMC days are significantly higher than on non-FOMC days, with every G10 currency appreciating against the dollar, on average. Outside of announcement days, returns cluster close around zero. The largest gains appear in AUD, CAD, and NZD, currencies that typically behave as high-beta plays on global risk sentiment, while the Japanese yen shows almost no reaction at all.

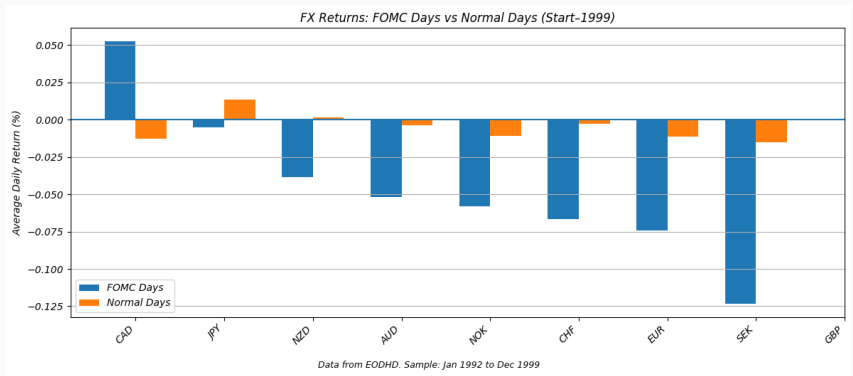

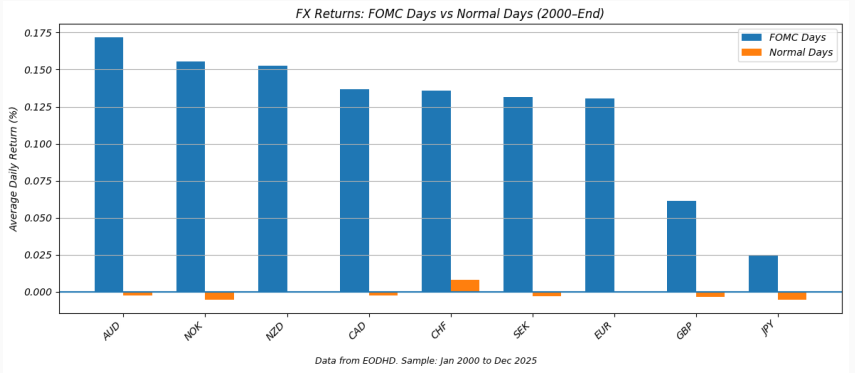

When I split the sample below, an interesting structural shift emerges: The pronounced USD weakness around FOMC announcements is almost entirely a post-2000 phenomenon. In the early part of the sample, the pattern is weak or absent, but starting in the early 2000s, the effect becomes larger, more consistent, and more broadly distributed across currencies.

This shift is possibly related to the Fed’s increasing communication transparency after the late 1990s, when statements, forward guidance, and press conferences became central to monetary policy transmission.

Pre-2000

Post-2000

The leading academic explanation for the “risk-on” FOMC effect is the resolution of monetary policy uncertainty. In the days before an announcement, investors face uncertainty about the policy path, and risk-taking is constrained. As the announcement approaches, this uncertainty is gradually resolved, freeing up risk-bearing capacity and triggering a broad repricing of risky assets, including a weaker U.S. dollar.

The strong USD depreciation on FOMC days has been documented by, for example, Mueller et al. (2017), who show that currencies earn unusually high excess returns against USD on FOMC days precisely because investors demand compensation for bearing monetary policy uncertainty, with the effect strongest for high-yielding currencies.

In a recent paper, Lin et al. (2025) extend this by demonstrating that currencies with greater ex-ante sensitivity to policy uncertainty (measured via option-implied expected variance reduction) earn systematically larger announcement-day premia, driven both by pre-announcement uncertainty resolution and exposure to pure policy shocks.

With this foundation in place, the natural next step is to ask whether the effect varies depending on the policy action itself and if the effect is tradable.

Does the dollar behave differently on rate-hike days versus rate-cut days?

And can this pattern be turned into a simple trading strategy?