Timing Leveraged Equity Exposure in a TAA Model

How a Simple VIX-based Filter Boosts Returns and Reduces Drawdowns

Hi there,

Leveraged ETFs like SPXL and TQQQ are built to deliver a multiple of daily index returns. They can produce spectacular gains in trending markets, but are vulnerable to volatility drag when conditions turn choppy. Because leverage is reset daily, compounding effects accumulate over time, often leading to underperformance in volatile, mean-reverting markets, but sometimes generating outsized returns in calm, trending markets.

Quantpedia recently highlighted this dynamic in their article Leveraged ETFs in Low-Volatility Environments (drawing inspiration from Zarattini et al., 2025, on volatility-based strategies), showing how a simple filter that compares realized and implied volatility can improve the timing of leveraged equity exposure.

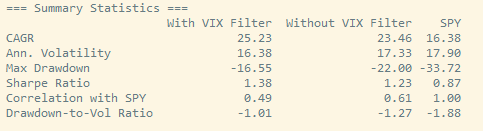

In this piece, I extend those insights by integrating a volatility filter, with some modifications, into the Tactical Asset Allocation (TAA) model I’ve discussed before. The goal is to better time allocations between leveraged equity (e.g., SPXL) and cash. The results show meaningful improvements in CAGR, Sharpe ratios, and drawdowns.

Let’s dig into the details.